gilti high tax exception election statement

Department of the Treasury and the IRS released final global intangible low-taxed income GILTI regulations under Internal Revenue Code Section 951A and related foreign tax credit regulations. On June 14 2019 the US.

Latest International Tax Regulations Update Final Gilti High Tax And Fdii Youtube

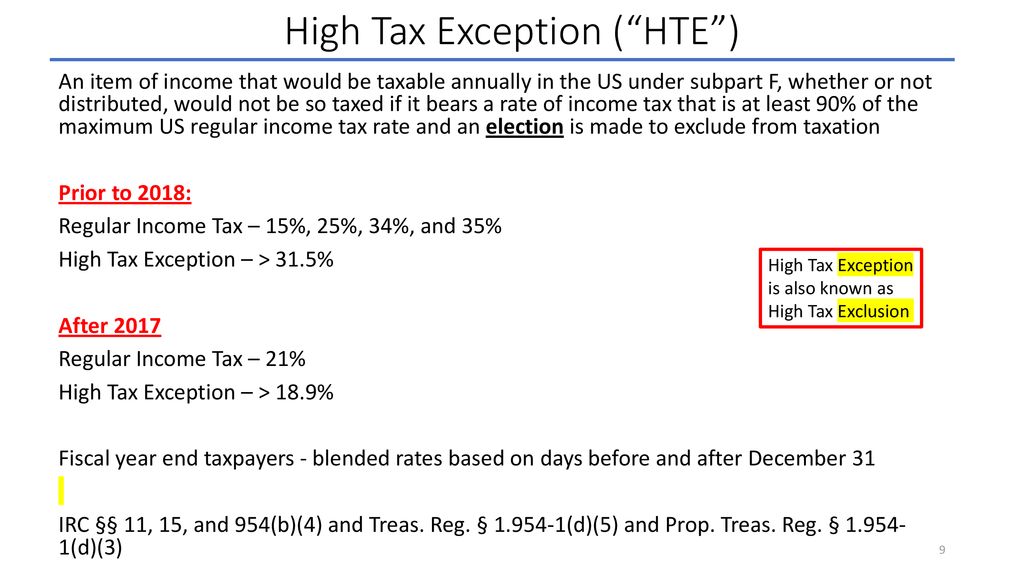

The high-tax exception in Reg.

. Conformity to subpart F high. Treasury and the IRS also released a. A summary of the key aspects of the GILTI high-tax election is as follows.

2022 January Special School Board Elections Timeline. Among the key points of the final regulation. Affirmatively elect to apply the high tax excep tion to exempt both subpart F under IRC 951 and GILTI inclusions Under IRC 951A from US federal income tax if the effective tax rate on that.

The 2019 proposed regulations in part provided that an election may be made for a controlled foreign corporation CFC to. In general 962 allows an. The IRS issued the Global Intangible Low-Taxed Income GILTI high-tax exclusion final regulations on July 20 2020.

2022 Primary Election Timeline. Final GILTI HTE regs provide flexibility. The controlling domestic shareholder of a CFC or CFC group may claim the high-tax exclusion on an annual basis by filing an election statement.

Shareholders of CFCs can exclude global income earned in high tax jurisdictions from their GILTI inclusion. Unitary High-Tax Exception. The IRS issued the Global Intangible Low-Taxed Income GILTI high-tax exclusion final regulations on July 20 2020.

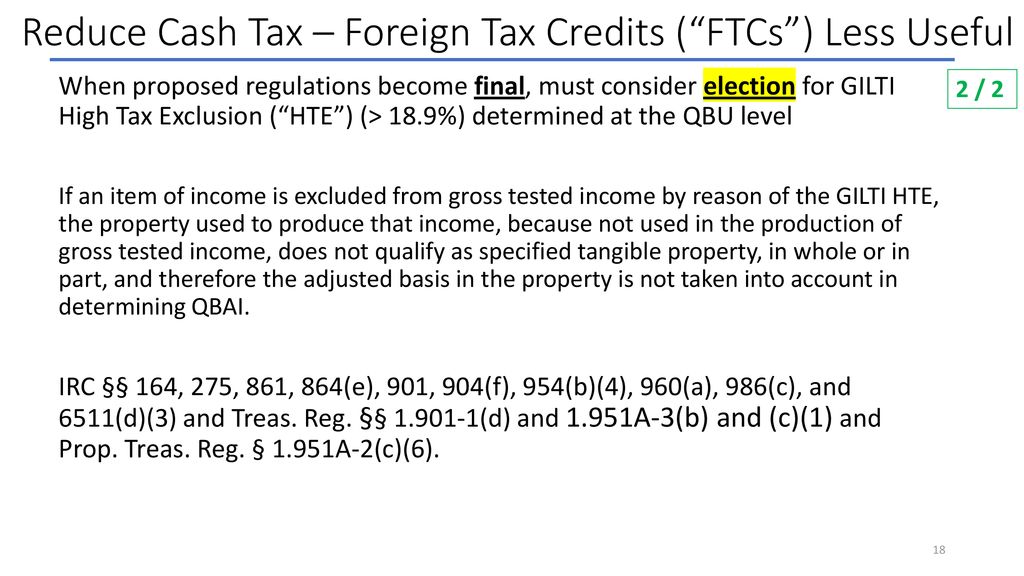

New GILTI Regulations Include High-Tax Exception Election Change for Partnerships S Corporations. 2022 General Election Timeline. The 2020 Proposed Regulations combine the Subpart F high-tax exception and GILTI high-tax exception elections into a unitary rule.

By making the GILTI high-taxed election gross tested income does not include gross income. On June 21 2019 Treasury published proposed regulations REG-101828-19 under Sections 951 951A 954 956 958 and 1502 in the Federal Register 84 FR 29114 as corrected at 84 FR 37807. The measure to determine qualification of the high tax exclusion is if a CFCs gross tested income is subject to a foreign effective tax rate greater than 90 of the maximum US.

Retroactive high-tax exclusion HTE election to exclude specific controlled foreign corporation gross income from being subject to the GILTI regime to the extent such gross income was. Shareholder of a controlled foreign corporation CFC. Final GILTI High-Tax Exception.

Shareholder of a controlled foreign corporation CFC. With the introduction of the GILTI high-tax exception regulations taxpayers now have another strategy available that can be even more beneficial. 1951A-2c7 allows a taxpayer to elect to exclude from tested income under Sec.

The IRS released final regulations TD. Comments on the proposed GILTI regulations recommended that a high-tax exception similar to the one under Subpart F should be provided for GILTI. 9902 on July 20 that expand the utility of the global intangible low-taxed income GILTI high.

As a result electing to apply the high-tax exception would impact all aspects of a taxpayers Subpart F and GILTI computations as well as calculation of section 904d limitation for the relevant section.

How Foreign Subsidiary Owners Can Plan For Gilti Hte

The Costs And Benefits Of The Gilti High Foreign Tax Exception Accounting Services Audit Tax And Consulting Aronson Llc

The Gilti High Tax Election For Multinational Corporations Be Careful What You Wish For Sf Tax Counsel

Let S Talk About Form 5471 Information Return Of U S Persons With Respect To Certain Foreign Corporations Htj Tax

Gilti High Tax Exclusion Final Regulations Crowe Llp

Insight Fundamentals Of Tax Reform Gilti

Demystifying Irc Section 965 Math The Cpa Journal

Insight Fundamentals Of Tax Reform Gilti

Gilti High Tax Exception Final Regulations

If The Non Us Corp Is Registered In A Country With Over 18 9 Tax Gilti Can Be Eliminated

The New Gilti And Repatriation Taxes Issues For Flowthroughs

Harvard Yale Princeton Club Ppt Download

954 C 6 Considerations For 2021 Global Tax Management

Demystifying Irc Section 965 Math The Cpa Journal

Harvard Yale Princeton Club Ppt Download

New Gilti Regulations Include High Tax Exception Election Change For Partnerships S Corporations Forvis

Latest International Tax Regulations Update Final Gilti High Tax And Fdii Youtube

Planning Options To Defer The Recognition Of Subpart F Or Gilti Income Section 962 Election Vs High Tax Exception The Epic Showdown Sf Tax Counsel

Gilti High Tax Exclusion How U S Shareholders Can Avoid The Negative Impact Sc H Group